Operation DoppelBrand: Weaponizing Fortune 500 Brands

Summary

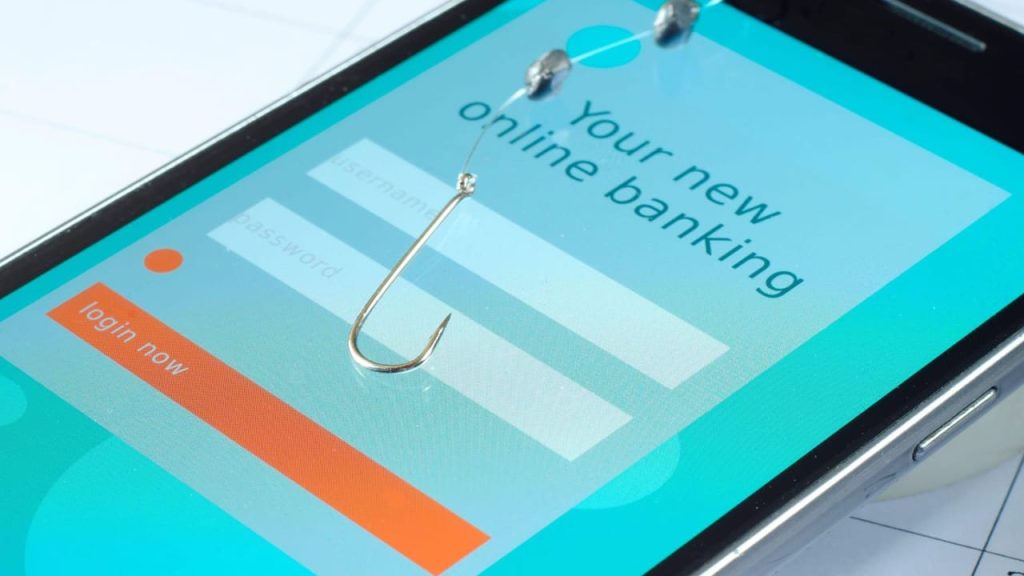

An organised cyber‑crime group tracked as GS7 is running an ongoing campaign called Operation DoppelBrand that targets high‑value organisations — notably US financial institutions such as Wells Fargo, USAA, Navy Federal Credit Union, Fidelity and Citibank — by creating near‑perfect imitation login portals to harvest credentials.

SOCRadar’s whitepaper, published after activity observed between December and January, details how GS7 builds and rotates sophisticated phishing infrastructure (more than 150 malicious domains), routes traffic through services like Cloudflare, and exfiltrates harvested data to Telegram bots. The group collects usernames/passwords plus metadata (IP, geolocation, device/browser fingerprints, timestamps) and often deploys remote management tools to secure persistent access; researchers suspect GS7 may act as an initial access broker, selling access to affiliates or ransomware groups.

Key Points

- GS7 conducts Operation DoppelBrand, impersonating Fortune 500 brands to harvest credentials via convincing fake login portals.

- Targets include major US financial institutions and companies across tech, healthcare and telecoms; the group focuses on English‑speaking markets while expanding into Europe.

- Attackers registered 150+ malicious domains and used Cloudflare to obscure backend infrastructure, complicating detection.

- Harvested data (credentials, IP/geolocation, device/browser fingerprints, timestamps) is exfiltrated to Telegram bots and groups controlled by the actor.

- GS7 installs RMM tools post‑compromise to gain remote access; researchers warn the group may sell access as an initial access broker.

- SOCRadar published TTPs and IoCs to help defenders; recommended mitigations include MFA and cautious login hygiene.

Context and Relevance

Phishing remains a leading vector for initial access, but Operation DoppelBrand shows how brand impersonation has matured to enterprise scale: attackers now replicate corporate portals with such fidelity that ordinary users can be easily fooled. The campaign also demonstrates the blurring lines between phishing operators and initial access brokers — a worrying trend for organisations that trust perimeter controls alone.

For security teams, financial institutions and large enterprises, this is an important case study in supply‑chain style risk (trusted brands weaponised), operational security for domain registrars and underground resale markets. The SOCRadar whitepaper and IoC list are useful for threat hunting and blocking infrastructure tied to GS7 activity.

Why should I read this?

Because crooks are cloning banks so well you might log in and hand them the keys without realising. If you or your organisation does online banking, manages access to financial systems, or runs detection for customer‑facing portals, this is short, useful intel that tells you exactly why MFA, phishing awareness and IoC hunting matter right now.

Author’s take

Punchy and plain: this is a tidy reminder that polished brand impersonation + scale = big risk. Read the SOCRadar details if you defend high‑value targets — the technical indicators could save you hours of chasing down a breach later.