Tired of sky-high memory prices? Buckle up, we’re in this for the long haul

Summary

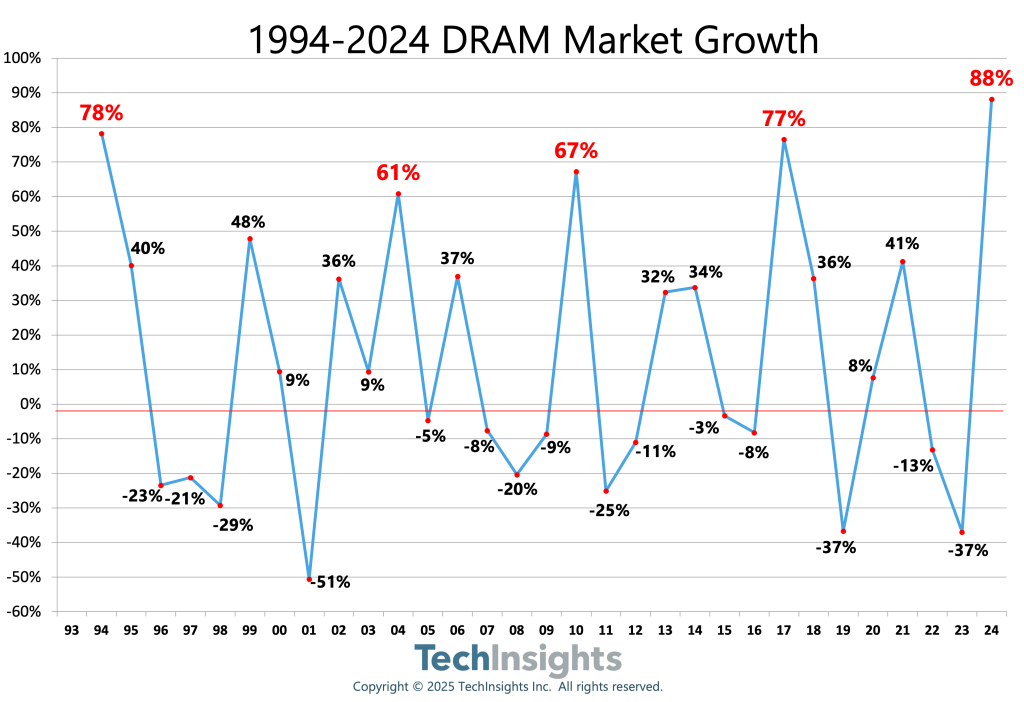

TechInsights tells The Register that DRAM prices will remain elevated for the foreseeable future, with a likely peak in 2026 and market normalisation only through 2027 before further rises. The current surge is driven by AI demand — particularly for high-bandwidth memory (HBM) used in datacentre GPUs and AI accelerators — combined with poor timing for capacity expansion. Memory fabs are investing and profiting, but new production takes years to come online and much of the new capacity will target enterprise-class memory rather than consumer modules.

Author’s take (punchy): This one matters — if you buy memory, kit or run procurement, expect sticker shock for a while. We read the detail so you don’t have to — but do pay attention.

Key Points

- DRAM prices rose sharply in 2024 and are expected to peak in 2026, with a settled market arriving around 2027.

- AI workloads are the primary demand driver, especially for HBM used in datacentre GPUs and AI accelerators.

- Memory markets are splitting: HBM and enterprise memory command premiums and diverge from consumer DRAM pricing.

- Building new fabs and ramping capacity takes 3–5 years, so supply response is slow and poorly timed to current demand.

- Large OEMs that lock in orders early are less affected; smaller vendors and consumers face spot-price volatility.

- Suppliers like Micron are reporting strong revenues and profits amid shortages, enabling potential fab investments.

- Chinese supplier CXMT is a wildcard — it’s expanding DDR5 capacity and could capture 5–10% of the market by decade-end despite export controls.

Content summary

TechInsights analyst James Sanders explains that the AI-driven surge in demand began at a bad point in the DRAM cycle for vendors. Redirecting wafer capacity to HBM and enterprise memory, plus the long lead times for new fabs, means prices will remain inflated. HBM’s specialised nature and lack of consumer demand detach it from conventional DRAM markets, creating two increasingly separate memory markets. While fabs are profitable now, meaningful new supply for consumer-grade memory will lag and may not ease prices for several years.

Context and relevance

Why this matters: organisations buying servers, GPUs or memory modules will face higher procurement costs and supply uncertainty. The trend is directly tied to the expansion of AI datacentres and next-generation HBM (HBM4/HBM4e) for chips shipping from 2026–2027 onwards. Procurement teams should consider longer lead times, prioritise contract locking where possible, and expect enterprise-focused capacity to remain the priority for vendors.

Why should I read this?

Short version: planning or buying IT kit? This affects your budget and timings. If you think you can wait for cheaper memory next quarter — think again. The piece explains who wins (fabs and enterprise buyers) and who loses (spot-market buyers and some consumer markets), so you can make smarter buying or upgrade choices.

Source

Source: https://go.theregister.com/feed/www.theregister.com/2025/12/20/memory_prices_dram/